Manufacturing CFOs Expect Growth in 2014

The most recent Business Outlook quarterly survey report from the Manufacturers Alliance for Productivity and Innovation (MAPI) indicated that manufacturers are looking forward to growth in the coming year. The survey also showed that, as of the end of September, business for 2013 is looking more robust than it had at the end of June.

MAPI Business Outlook survey results are optimistic

The most recent Business Outlook quarterly survey report from the Manufacturers Alliance for Productivity and Innovation (MAPI) indicated that manufacturers are looking forward to growth in the coming year. The survey also showed that, as of the end of September, business for 2013 is looking more robust than it had at the end of June.

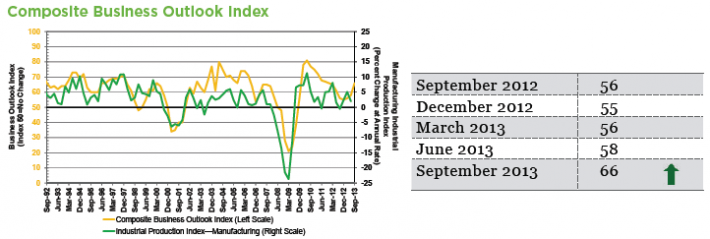

The MAPI’s September 2013 composite index, considered to be a leading indicator for manufacturing, was at 66, compared to 58 in the June survey. (An index of 50 means that the business conditions are neither better nor worse. The higher the index, the more positive the manufacturing CFOs feel about the industry.) This was the third straight quarterly advance, and the highest since December 2011. That’s 16 quarters of expansion.

Composite Index from MAPI

Composite Index from MAPI

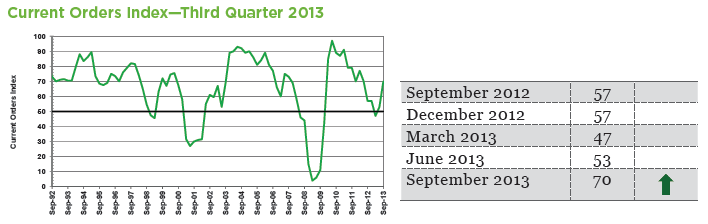

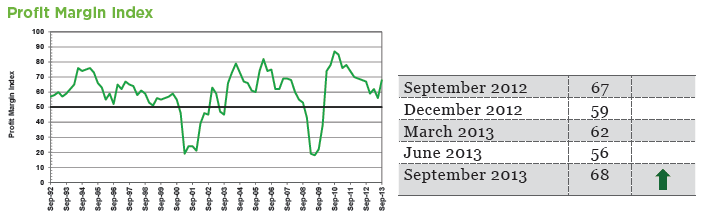

As for current business, orders are up. September’s index of current orders came in at 70, much more positive than the generally neutral level of 53 in June. Profits looked better in September too. Three months ago the index was at 56, indicating that current orders were slightly above the level of the preceding 12 months, but it is up to 68 in the most recent report.

Current Orders Index from MAPI

Current Orders Index from MAPI

Profit Margin Index from MAPI

Profit Margin Index from MAPI

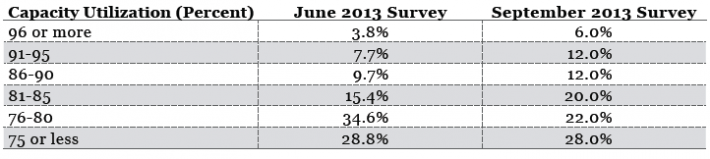

Capacity utilization is also up. In 18% of companies, it was up to 91% or more while only 11.5% of the companies surveyed were at that level in June. In addition, more companies had moved up to the 81-90% utilization range in September — 32% of them compared to 25% in June. In more than a quarter of the companies responding, capacity utilization remained below 75% unchanged since June.

Capacity Utilization Table from MAPI

Capacity Utilization Table from MAPI

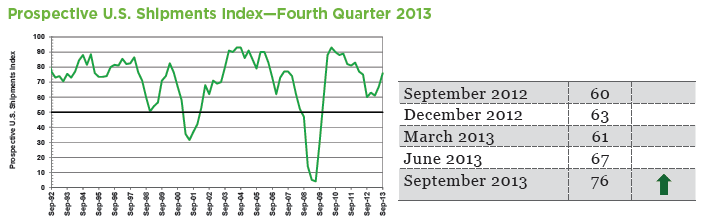

Manufacturers continue to have a positive outlook about U.S. shipments for the next three to six months. The fourth quarter of 2013 looks good to many of the respondents, for an index of 76. That’s compared to the June 2013 level of 67.

2013 4th Quarter Projections from MAPI

2013 4th Quarter Projections from MAPI

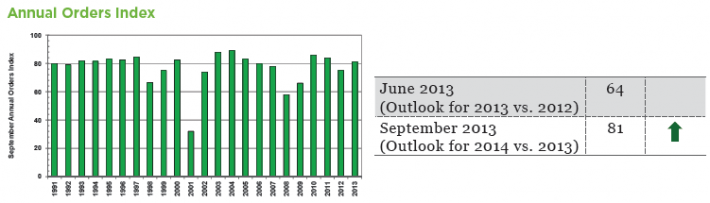

As for predictions for 2014 annual orders compared to 2013, the September index of 81 indicates strong optimism. In June, comparing 2013’s orders to 2012, responses produced an index of 64, much less bullish than September’s outlook for the year.

Annual Orders Index from MAPI

Annual Orders Index from MAPI

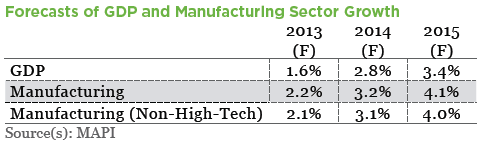

Optimism aside, MAPI predicts a relatively slow growth rate for the manufacturing sector as a whole:

- 2.2% for 2013

- 3.2% for 2014

- 4.1% for 2015

GDP Forecast from MAPI

GDP Forecast from MAPI

The Manufacturers Alliance for Productivity and Innovation (MAPI) conducts research to influencing large corporations. Those OEMs make forward-looking decisions that directly affect smaller suppliers. Keeping an eye on MAPI indexes can help companies of all sizes add another dimension to their demand forecasts for the year ahead.

Images courtesty of MAPI.

Karen Wilhelm has worked in the manufacturing industry for 25 years, and blogs at Lean Reflections, which has been named as one of the top ten lean blogs on the web.

- Category:

- Industry

- Manufacturing

Some opinions expressed in this article may be those of a contributing author and not necessarily Gray.

Related News & Insights

Advanced Technology, Automation & Controls

Four Use Cases for AI's Growing Role in Manufacturing

Industry

November 25, 2024Data Centers

Gray Expands Reach with Dallas Office

Corporate News

November 14, 2024Manufacturing, Construction

The Evolving Role of Electric Vehicles in Sustainable Construction & Design

Industry

October 18, 2024