It’s Not Your Father’s Car Industry

With car and truck manufacturers consolidating and technologies converging, a new transportation landscape is emerging

General Motors is closing five North American automotive plants and cutting 15 percent of its 54,000 North American jobs, white-collar and blue-collar alike. Ford has said it will focus on trucks and eliminate most of its car production, an exception being the Mustang. And the ubiquity of phone-based, ride-hailing apps and electric or autonomous vehicles are increasingly making the prospect of owning and operating a car optional for a growing number of Americans.

What was a rite of passage for millions of people (your first car, your first new car, the family sedan or minivan, the middle-age-crisis Corvette) is giving way to using new ways of getting around and how we pay for it.

There’s Something Happening Here

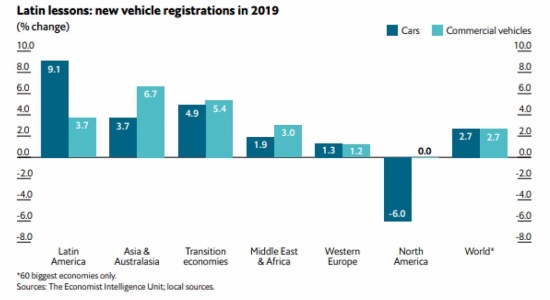

New vehicle sales remain robust, reporting growth over the last nine years since coming out of the economic downturn of 2009. But new growth regions are emerging. According to what the Economist Intelligence Unit calls “2019 supply shocks,” vehicle sales will again improve this year, but it is Latin America that will be the region leading the charge at 9.1 percent improvement from 2018 for cars and 3.7 percent for commercial vehicles. Worldwide, the numbers even out with growth numbers showing 2.7 percent improvement for both new cars and new commercial vehicles. The shock is that North America is shown to have no growth in 2019 commercial vehicles and a 6.0 percent reduction in new car registrations in 2019.

With nothing like $4/gallon gas on the horizon, brands that sell nothing but SUVs and crossovers are positioned to succeed, confirms Robert Schoenberger, editor, Today’s Motor Vehicles in a recent webinar.

MaaS Effect

Even the terms being used to discuss transportation issues are changing. One of the newest is “mobility as a service” or MaaS. Born in Sweden and Finland, MaaS is seen as a concept combining ride-hailing services, sophisticated travel planning, navigation technologies and online cost-payment services. The US-based Center for Automotive Research (CAR) reports, “Automakers and suppliers are placing big bets on technology – from advanced propulsion and automation to the use of new materials and manufacturing processes. Much is changing about the product and the processes used to make it, but change also is coming in how consumers purchase and use vehicles, including new business models such as buying “mobility-as-a-service,” and that is driving new investments in ride-sourcing (such as Uber and Lyft), ride sharing, and micro-mobility initiatives from automakers and new competitors.”

And not even new competitors necessarily, but new partners. Fiat Chrysler America and Waymo (the automated vehicle unit of Google parent Alphabet) have been collaborating for several years, and ride-sourcing companies such as Uber and Lyft also have partners for development of automated driverless vehicles. BMW and Daimler recently formed a joint venture to offer mobility services.

With the development of smarter algorithms and more processing power to crunch big data more effectively, multiple modes of transportation, planning and payment will figure into developing MaaS strategies. MaaS travel planning typically begin with a trip planner that can show how the user can get from one destination to another by using a robo-taxi, a pop-up bus connection, and even urban bike- and electric scooter-sharing sources. The user then chooses their preferred trip based on cost, time and convenience. At that point, any necessary bookings such as calling a taxi, or, for longer distance needs, reserving a seat on a train would be performed as a unit. Eventually, it is expected MaaS services should allow roaming, that is, the same end-user app should work in different cities, without the user needing to become familiar with a new app or to sign up to new services.

Ride-hailing will eventually be seen as cost-effective, particularly as driverless autonomous vehicles catch on. Ride-hailing services in the rich world currently cost around $2.50 per mile, more than twice the $1.20 per mile it costs to own and operate a private car. But the Uber or Lyft driver accounts for about 60 percent of the cost of ride-hailing. New research reckons that automation, competition and electrification (which makes cars more expensive to buy but much cheaper to run) will cut the cost of ride-hailing by 70 percent, to about 70 cents per mile. This means a typical Western household driving 10,000 miles a year could ditch its car, use robo-taxis and save $5,000 a year.

Electric vehicles will also figure in to this new mix. Electrify America, a subsidiary of Volkswagen, plans to have 2,000 charging stations up and running by June, including fast chargers that can replenish an electrical vehicle’s battery in minutes at 100 Walmart stores.

Imagine a future of dramatically fewer privately owned cars. Parking garages and parking lots throughout urban and suburban landscapes could be repurposed, making cities more livable. Driverless vehicles would drastically reduce the horrific results of drunk or impaired driving. Saving thousands of dollars in insurance, fuel and car maintenance would mean more money in the pockets of more people. Car manufacturing is not going away, rather it is becoming part of a much more interesting future mobility picture.

Some opinions expressed in this article may be those of a contributing author and not necessarily Gray.

Related News & Insights

Manufacturing, Construction

Advanced Materials Will Transform the Lithium Battery Market

GrayWay

Manufacturing, Construction

Top 5 Trends Redefining Manufacturing in 2019

Industry, Opinion

Distribution, Construction

Advances in Metrology Science Set to Improve Manufacturing

Industry, Opinion

March 18, 2019