Forecast: U.S. Manufacturing to See "Broad-Based" Recovery in 2014

Prior to the third quarter of 2013, manufacturing was growing, but at what many economists would consider a snail’s pace. With Europe still emerging from its recent recession, the global economy remained sluggish and U.S. exports were down. This, combined with continuous government uncertainty due to a fiscal cliff scare, across-the-board spending cuts, a government shutdown and the debt ceiling, has eaten away at growth over the last two years, according to Chad Moutray, chief economist for the National Association of Manufacturers (NAM).

Prior to the third quarter of 2013, manufacturing was growing, but at what many economists would consider a snail’s pace. With Europe still emerging from its recent recession, the global economy remained sluggish and U.S. exports were down. This, combined with continuous government uncertainty due to a fiscal cliff scare, across-the-board spending cuts, a government shutdown and the debt ceiling, has eaten away at growth over the last two years, according to Chad Moutray, chief economist for the National Association of Manufacturers (NAM).

But, since then, demand has been picking up as illustrated by November’s Institute for Supply Management (ISM) Manufacturing Index, which rose to an unexpected 57.3, the highest since April of 2011. Indexes above 50 indicate growth; below, retraction.

Chad Moutray, Chief Economist for the National Association of Manufacturers (NAM)

Chad Moutray, Chief Economist for the National Association of Manufacturers (NAM)

“This suggests that manufacturers themselves are seeing pretty strong gains in their overall demand and, when you ask manufacturers about 2014, most of them are generally positive about output and demand next year,” said Moutray. “So that’s certainly a sign that we’re starting to get some traction, and definitely an improvement from where we were in early 2013.”

Still, employment overall is not where it was prior to the U.S. recession.

“That’s true of both the larger economy, as well as for manufacturing,” explained Moutray. “For the larger economy, we’re getting close. We’re at around 99 percent of the employment relative to where it was prior to the recession. Manufacturing, however, lost 2.3 million workers in the recession. We gained back some 543,000 since then so we’re still a long way from being at our pre-recession levels.”

From August to November, some 16,500 manufacturing jobs were added; over the previous five months, jobs were actually shed, Moutray said.

“In general, I think manufacturers will start hiring again when demand picks up and when they sense that the economy is starting to pick up and is on a firmer footing,” he said. “I think that has held back hiring for much of the last year, which is why I think we are going to see modest gains in employment over 2014.”

Moutray expects U.S. gross domestic product (GDP) growth to be over 3 percent in 2014. If his prediction rings true, this would be the first year since 2005 the U.S. GDP has grown to over 3 percent. He expects 2013’s GDP growth to settle in between 2.1 and 2.2.

And now that Congress seems to be trying to avoid financial crises rather than encouraging them, manufacturers are beginning to have more confidence in the economy.

“Congress has enacted a budget and that will prevent us from having a shutdown for at least two years,” said Moutray. “There still is some risk with the debt ceiling but, hopefully, that won’t happen either.”

Upswings in the transportation sector, both motor vehicles and aircraft, are largely responsible for manufacturing’s recovery, but Moutray says that is now starting to change.

“I think we are seeing broader-based recovery, even beyond autos and aircraft,” he said. “I think we are going to continue to see growth in the durable goods sector, and part of that is a spinoff of the auto and transportation sector gains. So, machinery is going to do well, metals are going to continue to do well—that’s really where we’ve seen a lot of the growth since the end of the recession, primarily in that durable goods space.”

Beyond durable goods, Moutray sees great potential for investments in the chemical manufacturing sector.

“We’ve already had a number of announced investments in plastics, chemicals, fertilizers—those sectors which are utilizing natural gas as a feedstock,” he said. “It’s hard not to be bullish about manufacturing over the course of the next decade, but I think even in the next couple of years we’re going to see a lot of improvements in terms of output, exports and hiring in plastics, chemicals, fertilizers… things which are taking advantage of the lower-cost energy.”

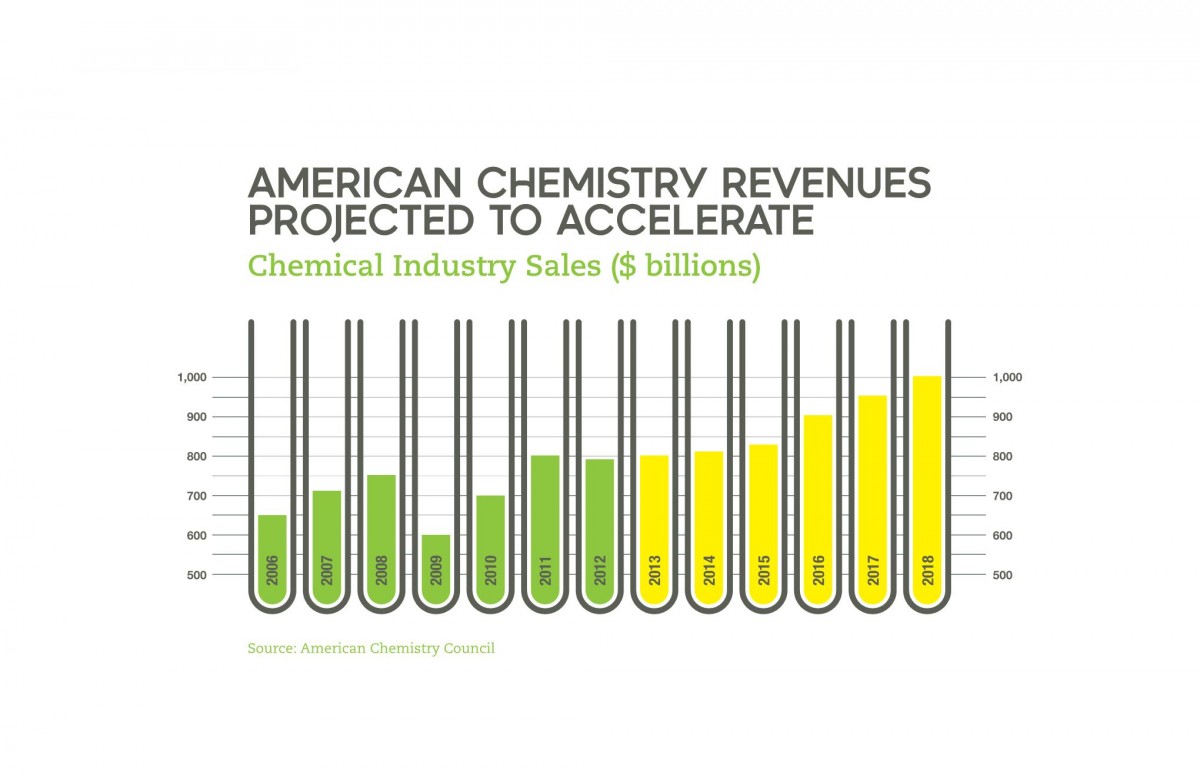

The American Chemistry Council reported that businesses have announced 147 projects representing a cumulative investment of $97.9 billion over the past two years. Moutray says many of these investments could take years before they are fully operational, so the benefits of these investments will be felt well into the future.

American Chemistry Council Projections

American Chemistry Council Projections

A recent study conducted by the global research firm IHS projects that the development of shale oil and gas will boost employment by almost 4 million jobs by 2025. Manufacturing output is slated to grow by $328 billion in just 12 years.

More broadly, lower energy prices will have a ripple effect on all manufacturers, which use roughly one-third of the energy consumed in the United States. Energy is quickly becoming a major competitive advantage for manufacturers.

In addition to investments being made by manufacturers based in the United States, Moutray says the U.S. is also seeing a rise in foreign direct investment. From 2001 to 2011, foreign direct investment rose from $476.5 billion to $838.3 billion, according to data from the Bureau of Economic Analysis.

“They’re coming to the U.S. to build a facility to manufacture a chemical and then export it back to their home country—basically, to do some arbitrage. So, that’s a pretty significant change, and certainly why people are talking about manufacturing and its importance right now.”

- Category:

- GrayWay

- Industry

- Manufacturing

Some opinions expressed in this article may be those of a contributing author and not necessarily Gray.

Related News & Insights

Advanced Technology, Automation & Controls

Four Use Cases for AI's Growing Role in Manufacturing

Industry

November 25, 2024Data Centers

Gray Expands Reach with Dallas Office

Corporate News

November 14, 2024Manufacturing, Construction

The Evolving Role of Electric Vehicles in Sustainable Construction & Design

Industry

October 18, 2024