The Growing Role Aluminum & Titanium Is Playing in the Manufacturing Resurgence

Two years of steady growth in the U.S. manufacturing industry has many convinced the resurgence of this important market segment is here to stay. Leading the way are the world’s automakers and aerospace manufacturers who have seen healthy gains over this time period.

Essential to the manufacturing of cars and planes is a robust metals market, capable of not only providing an adequate and diverse supply of metals to auto and aircraft makers, but also able to meet the ever-changing needs of these manufacturers as restrictions on fuel-efficiency and gas emissions tighten. The Corporate Average Fuel Economy bill requires automakers to increase fuel economy by 50 percent by the year 2025; this is largely being achieved by cutting the weight of cars, or “lightweighting.”

Rick Schreiber, Assurance Partner at the Manufacturing & Distribution Practice of BDO USA, LLP

Rick Schreiber, Assurance Partner at the Manufacturing & Distribution Practice of BDO USA, LLP

“Energy is a big cost component for the metals industry and metal manufacturing,” said Rick Schreiber, assurance partner, Manufacturing & Distribution Practice of BDO USA, LLP, a leading global accounting, tax and consulting firm. “With the energy renaissance, we’re seeing growth in the metals space, in addition to a lot of other spaces. We’re seeing more plants, but we’re also seeing more expansion projects too. That’s because the economy continues to be improving and consumer confidence continues to be going in the right direction.”

Compounding the demand for metals is the increasing need for lightweight metals that are not only strong, but durable and corrosion-resistant. Two standouts in this regard are aluminum and titanium, which are becoming more and more attractive as alternatives to traditional metals used by the auto and aerospace industries, like steel and iron.

ALUMINUM: A Lighter Choice

Aluminum is not a “new” metal to manufacturing. In fact, it has been used to make products since before the beginning of the Industrial Revolution. But the type of products aluminum is used to make has become more varied and diverse, with automakers and aerospace manufacturers now among its biggest users. Why? Because aluminum is lightweight, and while it’s not as strong as steel—the traditional metal used to manufacture cars and planes—new alloys are continually being developed to improve its strength and durability.

According to the International Aluminum Institute (IAI), over the last 30 years, aluminum consumption growth has outpaced all other metals. The world’s leading aluminum market is China, and the main industries with the highest aluminum consumption are construction and transportation.

Today, almost all automobiles feature aluminum components, from outer panels to engine parts. As evidence this trend will continue, the newest model of Ford’s F-150 will feature an all-aluminum body.

According to Richard Trillwood—an electrical engineer, inventor, and entrepreneur who has worked with aluminum over his long career in precision welding—aluminum is desirable not only because it is lightweight, it’s also easily recyclable, which is vitally important to manufacturers who are scurrying to meet EPA compliance standards in very short order.

Trillwood says the aerospace industry has a great need for higher-temperature and lighter-weight metals for use in the engine parts, and aluminum works well under these conditions.

“Any sort of weight reduction is imperative to the aerospace industry because they have to get aircrafts off the ground,” said Trillwood, who founded Electron Beam Engineering, Inc. (EBE), a precision electron and laser beam welding job shop

Richard Trillwell, Founder of Electron Beam Engineering, Inc. (EBE)

Richard Trillwell, Founder of Electron Beam Engineering, Inc. (EBE)

based in Anaheim, Calif. “And when it comes to fuel efficiency, using aluminum with any form of transportation is going to save fuel since the vehicle is going to be lighter than if it was made of steel.”

To meet the demand of the booming aerospace industry, Alcoa—a global leader in lightweight metals technology, engineering and manufacturing—recently opened the world’s largest aluminum-lithium facility in Indiana, representing a $90 million investment. The plant will make aluminum-lithium alloys to be manufactured into aircraft parts for commercial jets built by Airbus, Boeing and Gulfstream.

“The future of aviation is being built with aluminum-lithium, and Alcoa is making big moves to capture that demand,” said Klaus Kleinfeld, chairman and chief executive of Alcoa.

Alcoa has additionally expanded its aluminum-lithium capabilities at facilities in Pittsburgh and the United Kingdom to keep pace with demand. Already, the company has contracted $100 million in aluminum-lithium revenues for 2017.

Each year, Alcoa publishes its Aluminum Industry Outlook. For 2014, the company is projecting seven percent growth in the global consumption of primary aluminum—consistent with that of the two prior years. All regions except Europe are expected to have 3-to-8 percent increases in aluminum demand over 2013, with China (10%) expected to have the highest growth rate during the year.

With raw aluminum prices dropping dramatically since 2011, Alcoa is betting these investments increase their profit margins. With that said, aluminum remains some three times more expensive than steel on a per weight basis.

TITANIUM: A Metal for All Things, Big and Small

Another emerging contender in the metals market is titanium, also driven by the demand for lightweight metals in the automotive and aerospace industries. But titanium is being lauded as a strong alternative to traditional metals for a number of other reasons, like its superior corrosion- and abrasion-resistance that make it desirable for many more manufacturing applications, large and small.

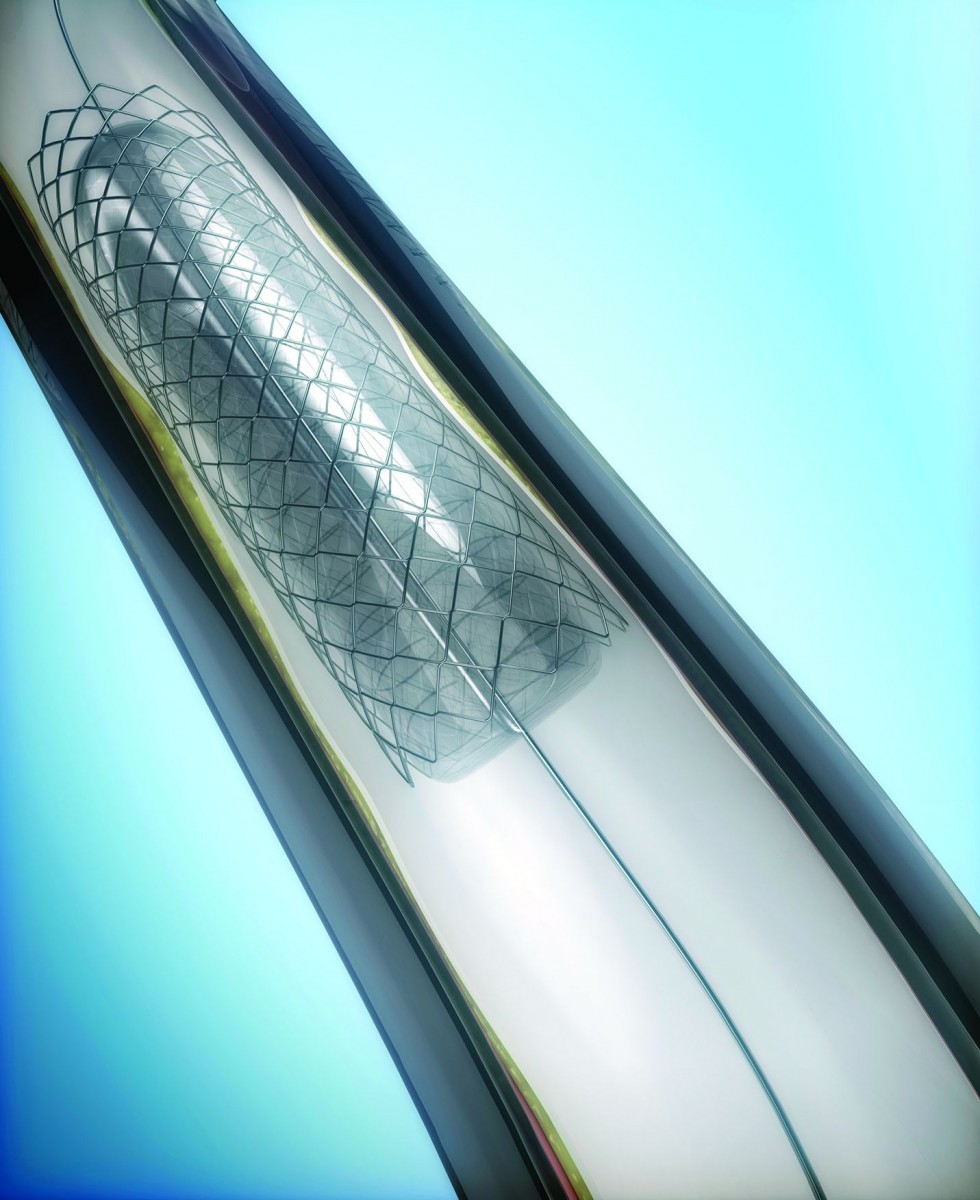

Many implantable medical devices, like this heart stent, are made from titanium and titanium alloys. Titanium is highly corrosion-resistant and is classified as insert biomaterial, meaning it does not change once implanted into the body.

Many implantable medical devices, like this heart stent, are made from titanium and titanium alloys. Titanium is highly corrosion-resistant and is classified as insert biomaterial, meaning it does not change once implanted into the body.

“Titanium has been doing extremely well over the last four or so years and I expect that to continue as well,” said BDO’s Schreiber. “What I’m seeing is very similar to aluminum—aerospace seems to be its largest growth driver, again all from the more fuel-efficient reasons there, but also other consumer goods are helping drive titanium.” Trillwood agrees, and says while titanium costs much more than aluminum per pound, its positive attributes are sometimes worth the added cost to manufacturers.

“Titanium is a lot more expensive than aluminum, and yet, in some aerospace applications, strength and weight can be a requirement, whereas with aluminum alloys, you have less strength, but you don’t always meet the strength requirements,” he said. “That isn’t to say aluminum is not strong, but I’m comparing one with the other.”

For instance, Lockheed Martin’s latest F-35 fighter jet has been getting a lot of media attention due its heavy price tag—the U.S. government is spending an estimated $400 billion to produce over 2,400 of these jets through 2037.

“Great chunks of these jets are made out of titanium—something you would never think of making a commercial product because of the cost of these very large pieces of titanium,” said Trillwood. “But their principal requirement was to make a jet that was as strong as possible because of its performance, so cost wasn’t the principal barrier to using titanium.”

In the smaller component business, Trillwood says titanium is ideal for products that require strength, weight reduction and corrosion-resistance, like implantable medical devices.

“For instance, pacemakers, artificial heart pumps and prostheses are devices that need to be biocompatible,” said Trillwood. “In the early days, some of these parts were made out of stainless steel and they didn’t have the long-term stability and corrosion-resistance that titanium does. I would say, currently, most of the implantable devices in the human body are titanium.”

According to Iluka, a global mineral sands exploration and mining company, industrial applications are the highest-growing end use for titanium metal, including the chemical, shipping, desalination, oil and gas, power generation, metallurgy and auto industries.

- Category:

- GrayWay

- Industry

- Manufacturing

Some opinions expressed in this article may be those of a contributing author and not necessarily Gray.

Related News & Insights

Manufacturing, Automation Solutions

Exploring the Next Generation of Industrial Manufacturing Robots

Industry

March 03, 2026Manufacturing, Design

Process Makes Perfect: Driving ROI through Manufacturing Process Optimization

Industry

March 03, 2026Distribution, Robotics & Vision Systems

Shining a Light on the Lack of Fully Automated "Dark Factories"

Industry

January 06, 2026