Booming Natural Shale Gas Industry Key to U.S. Manufacturing Resurgence

With manufacturing on the rise in America, experts believe the booming natural shale gas industry is playing a key role in this resurgence and could pave the way for a much stronger comeback in the coming years.

Deep below the earth’s surface in shale rock deposits across America lies a resource many believe is playing a vital role in the resurgence of manufacturing in the U.S.: natural gas. According to the U.S. Department of Energy, the U.S. sits atop one of the largest natural shale gas reserves in the world, and may hold the key to an energy-independent America in the not-so-distant future.

Hal Sirkin, Senior Partner, Boston Consulting Group

Hal Sirkin, Senior Partner, Boston Consulting Group

Some have estimated there is enough natural gas in these reserves to supply the country for the next 100 years. Others believe this estimate is conservative. But what’s most alluring about this ever-more-plentiful resource… simply put… it’s really cheap.

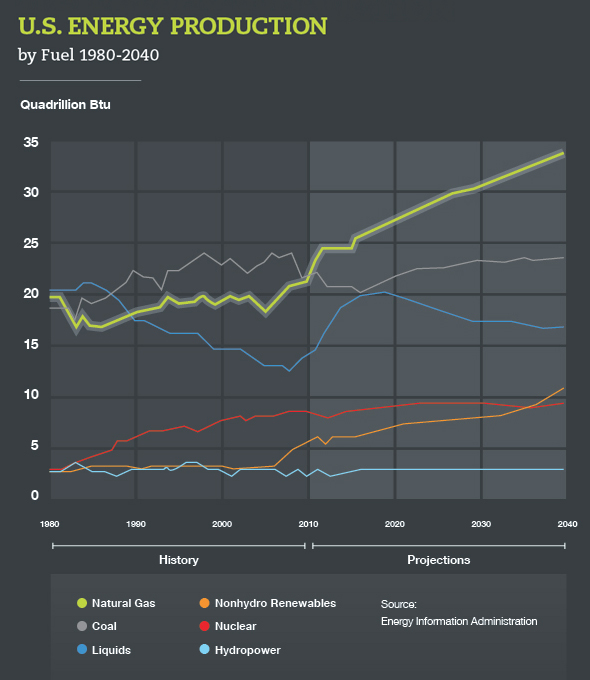

The U.S. Energy Information Administration (EIA) says that, today, shale gas reserves account for some 25 percent of the country’s total natural gas production. In its 2013 Annual Energy Outlook, the EIA predicts that natural gas use by the industrial sector will increase 16 percent over a 14-year period. What’s more, a September 2012 analysis by the Boston Consulting Group estimates up to five million manufacturing and related service jobs will be created by 2020, partly as a result of the U.S. shale gas boom.

“I think when you put natural gas advantages together with the labor advantages that we have right now, it’s a very powerful combination,” said Hal Sirkin, a Chicago-based senior partner with the Boston Consulting Group and coauthor of The US Manufacturing Renaissance: How Shifting Global Economics Are Creating an American Comeback.

“Even if you’re a small business, taking one point off your cost structure could be the difference between winning and losing,” he continued. “And so I think this gives U.S. companies a really tremendous advantage.”

Manufacturers whose products are dependent upon natural gas as a chemical feedstock in their manufacturing processes are among the biggest users of natural shale gas at the present time, says Chris Faulkner, founder and CEO of Breitling Oil and Gas in Irving, Texas, an oil and gas exploration and production company.

Chris Faulkner, CEO, Breitling Oil and Gas

Chris Faulkner, CEO, Breitling Oil and Gas

“If you look at 2011 alone, 17 different chemical, metal, industrial, fertilizer, and ethylene manufacturers commented in their public filings with the SEC that the shale gas developments are driving the cost of their products down, and also driving them to relocate jobs back in the United States,” said Faulkner.

Faulkner says Dow Chemical provides the perfect example of a manufacturer bringing jobs back to the states due solely to cheap natural gas prices. In December of 2012, the company announced its comprehensive plan to “further connect its U.S. operations with cost-advantaged feedstocks from increasing supplies of U.S. shale gas is moving forward, and remains on-track to deliver long-term competitive advantage for many of Dow’s downstream businesses.”

Dow is planning multimillion-dollar feedstock and other capital investments on the U.S. Gulf Coast, including construction of an ethylene production plant for startup in 2017, and a new propylene production facility at Dow’s Texas operations for startup in 2015.

“Our U.S. Gulf Coast investments represent a game-changing move to strengthen the competitiveness of our high-margin, high-growth derivatives businesses as we continue to capture growth in the Americas,” said Brian Ames, Dow business president of Olefins, Aromatics and Alternatives. “Today, 70 percent of the company’s global ethylene assets are in regions with cost-advantaged feedstocks – and we’ve seen the benefits this advantage provides even while the global industry is at mid-cycle operating rates.”

While a bountiful natural gas industry is good news for manufacturers with plants here, there are still a number of manufacturing sectors that are not taking advantage of its cost-reducing potential. Likewise, the U.S. transportation industry has been hesitant to invest in natural shale gas as a cheap fuel source. Faulkner says this is because there is not enough access to natural shale gas for it to be a reasonable fuel alternative for the average U.S. vehicle or fleet owner.

“That requires a domestic energy policy that puts natural gas at the forefront of power generation and transportation,” said Faulkner. “There’s only 980 compressed natural gas or liquefied natural gas refueling stations; there’s 260,000 gasoline and diesel refueling stations, so it doesn’t take a rocket scientist to figure out why it hasn’t caught on. Folks aren’t going to embrace it if there isn’t a way to go to their neighborhood convenience store and refuel their car.”

Both Faulkner and Sirkin agree the time is now to use domestic energy to create a competitive advantage for business and industry across the U.S.

“One person said to me, we shouldn’t be saying God Bless America… we should be saying God has blessed America because we’ve been given this incredible opportunity one more time,” Sirkin said. “With relatively low-cost labor and incredibly cheap natural gas, we need to make the best of it because this is for our children. We are in a position today that, five years ago, no one had predicted.”

Faulkner concurred, “From an energy executive’s point of view, I’m not getting a lot of money from my natural gas production, but I think the lemonade from lemons here is that it’s creating an opportunity for America. And that outweighs the near-term financial impact that we can have in the oil and gas industry… creating a boon for America.”

- Category:

- GrayWay

Some opinions expressed in this article may be those of a contributing author and not necessarily Gray.

Related News & Insights

Distribution, Specialty Equipment

Equipment Manufacturing Trends for 2025

Industry, Opinion

Advanced Technology, Specialty Equipment

How an Equipment Design-Build Partner Benefits Your Business

Industry, Opinion

Shattering Ceilings & Laying Foundations: Women Who Transformed the AEC Space

Stories

March 25, 2025