Global Economic Crisis Driving Foreign Manufacturers to Reconsider the U.S. (Full Version)

Moving manufacturing operations to low-wage nations not only became customary over the past couple of decades, but some believe necessary. Now, as countries across the globe sink deeper into debt, poor economic conditions have forced companies to rethink their manufacturing strategies, and the United States is regaining some of the appeal it had all but lost to low-wage nations.

Moving manufacturing operations to low-wage nations not only became customary over the past couple of decades, but some believe necessary. Now, as countries across the globe sink deeper into debt, poor economic conditions have forced companies to rethink their manufacturing strategies, and the United States is regaining some of the appeal it had all but lost to low-wage nations.

Economists have varying opinions on why this is happening, but they all agree that the U.S. is still a force to be reckoned with on the manufacturing landscape, and is gaining more and more interest from foreign manufacturers every day.

Worker Productivity

Chad Moutray, chief economist for the National Association of Manufacturers (NAM), is one such expert who cites our nation’s high worker productivity rates as a key variable in attracting more interest from foreign manufacturers.

“Most people assume that the United States lost a lot of jobs to China due to labor costs,” began Moutray. “The reality is that the U.S. continues to be one of the most productive in the world—if not the most productive in the world—when it comes to manufacturing overall productivity.”

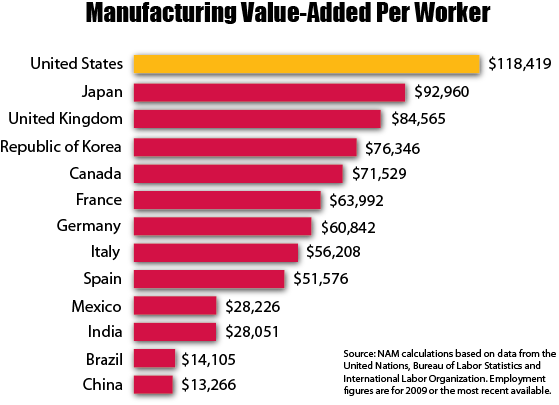

According to Moutray, the U.S. has the most value added per worker than any other of the top ten economies in the world, which levels the playing field when competing against low-wage nations. The most recent numbers published in 2009 by the Bureau of Labor Statistics indicate that the value added per worker in the United States was over $118,000, some $25,000 more than that of our closest competitor, Japan.

More recently, Moutray says U.S. worker productivity rates have made explosive gains.

“In the third quarter of 2011, you saw manufacturing productivity go up a little over 5 percent,” he said. “For durable goods, it’s well over 9 percent.”

“It doesn’t mean that everyone’s going to move back that moved over, but it means that if there is a need for additional facilities or if you’re looking at price comparisons for manufacturing products, I think the U.S. is going to be in the mix,” he said.

Near-Sourcing

Another trend emerging on the global manufacturing landscape is what many are referring to as “near-sourcing.” The concept of near-sourcing is simple: decreasing the distance between the source of supply and the market served. Now that labor and other costs are on the rise in traditionally low-wage nations like China, some say it is becoming more and more compelling to manufacture close to your biggest consumer markets. According to Brian Beaulieu, an economist with ITR Economics, despite the recent recession and credit crunch, the U.S. maintains its position as the “strongest, most vibrant consumer economy on the planet.”

“Our natural propensity to consume is second to none, as far as I know,” said Beaulieu.

“So, you build here because you want to be locally sourced to where your customers are.”

Keeping Perspective

No doubt, the U.S. has many reasons to believe foreign manufacturers will be looking this way for new locations, but Beaulieu says it’s not quite time to celebrate. One of our nation’s most beneficial trading partners is Europe, but his predictions for economic growth in Europe are meager at best. “We see (Europe) growing some in 2012, but at a very mild pace, slower than the U.S.,” he said. “And, in 2013, we see them underperforming the U.S.”

Beaulieu has even less optimism for the growth of Europe’s Gross Domestic Product.

“We think in 2012, it’ll be up around 0.7 percent, and in 2013, it will be essentially flat.”

Cash in the Coffers

Even if Beaulieu’s predictions ring true, he believes many of the world’s leading manufacturers are simply being cautious, waiting to invest until global economic conditions improve.

“All you have to do is look at what’s sitting on corporate balance sheets across America—it’s like $2 trillion in cash,” he explained. “And with the employment trend continuing to rise here in the U.S., and the capacity utilization rates generally moving up within the U.S., that means there’s going to be more building going on in the U.S. in 2012 and 2013.”

For investors, indicators of economic growth cannot come quick enough, and the news media has given them no reason to believe a brighter future awaits. While economists may be able to see the light at the end of the tunnel, the media has been reluctant to spread any good news about economic recovery. Beaulieu says this has caused confusion for potential investors.

“They are confused because they know personally it’s not all that bad, but they read all of this bad news,” said Beaulieu. “Are they on an island of prosperity in a sea of desperation, or is there really a distorted view of what’s going on out there?”

Expectations for Exporting

If European manufacturers do, in fact, decide to make more goods in the U.S. as some are predicting, the economic impact could be significant. But what may offset this impact somewhat is Europeans’ declining ability to purchase U.S.-made goods.

“Europe is a very important market for us,” said Moutray. “A lot of our manufacturers have a strategic presence in Europe in terms of having operations there. But even manufacturers who don’t have operations in Europe continue to sell there.”

According to the U.S. Department of Commerce, exports to Europe grew at double-digit rates in 2011. Some 22 percent of the U.S.’s total goods exports were sold to Europe in the first ten months of 2011. No doubt, these are impressive figures but Moutray says the impending European recession means less vigorous export growth.

“(Exports to Europe) have been one of the bright spots in the economy, but you’ve seen the overall growth rate of exports slow in recent months,” said Moutray. “So, basically, they’re buying less.”

- Category:

- GrayWay

Some opinions expressed in this article may be those of a contributing author and not necessarily Gray.